Maryland State Employee Earnings and Hourly Wage Data provides detailed compensation information for employees working for various state agencies, including salaries, bonuses, and overtime. It's a valuable resource that enables citizens and researchers to understand how public funds are allocated and to evaluate the fairness of state employee compensation.

The data is comprehensive and transparent, offering insights into the compensation structure of different job classifications within the state government. By accessing this information, individuals can make informed decisions and hold government agencies accountable for responsible fiscal management.

Historically, the availability of data on state employee salaries and hourly wages has been crucial for promoting transparency and ensuring equitable compensation practices. This article will delve deeper into the specific components of the data, its significance, and provide insights into the compensation trends and variations across different state agencies.

State Of Maryland Employee Salaries Earnings And Hourly

The essential aspects of "State Of Maryland Employee Salaries Earnings And Hourly" provide a comprehensive understanding of the compensation structure and workforce management practices within the state government. These aspects encompass various dimensions, including:

- Salaries

- Earnings

- Hourly Wages

- Overtime Pay

- Bonuses

- Benefits

- Job Classifications

- Agency Allocations

- Compensation Trends

- Historical Data

These aspects are interconnected and provide valuable insights into the state's human resource management policies, workforce distribution, and budget allocation. By examining these aspects, stakeholders can assess the fairness and competitiveness of state employee compensation, evaluate the efficiency of government spending, and make informed decisions regarding public sector workforce management.

Salaries

Salaries constitute the foundation of "State Of Maryland Employee Salaries Earnings And Hourly" data, representing the fixed compensation paid to state employees for their regular work hours. They serve as a crucial component in understanding the overall compensation structure and workforce management practices within the state government.

The data provides detailed information on salaries across various job classifications and agencies, allowing stakeholders to assess the fairness and competitiveness of compensation practices. By analyzing salary trends and distributions, policymakers can make informed decisions regarding appropriate salary adjustments and ensure that state employees are adequately compensated for their contributions.

For example, the data reveals that the average salary for state employees in Maryland is $65,000 per year. However, there is significant variation across different agencies and job roles. Employees in the healthcare sector, such as nurses and doctors, typically earn higher salaries compared to those in administrative or support positions. This information helps policymakers understand the market value for different skills and expertise and allocate resources accordingly.

Earnings

Earnings, within the context of "State Of Maryland Employee Salaries Earnings And Hourly" data, encompass all forms of compensation received by state employees beyond their base salary. This includes overtime pay, bonuses, shift differentials, and other forms of supplemental income.

Earnings play a critical role in understanding the overall compensation structure and workforce management practices within the state government. By analyzing earnings data, stakeholders can assess the extent to which employees are compensated for additional work hours, performance, and other factors. This information helps policymakers evaluate the fairness and competitiveness of compensation practices and make informed decisions regarding appropriate adjustments.

For instance, the data reveals that overtime pay constitutes a significant portion of earnings for certain job classifications, such as law enforcement officers and firefighters. This information highlights the need for proper staffing levels and workload management to ensure that employees are not overworked and that overtime costs are kept within reasonable limits.

Understanding the connection between earnings and "State Of Maryland Employee Salaries Earnings And Hourly" data is essential for effective workforce management and fiscal planning. By analyzing earnings trends and distributions, policymakers can identify areas for optimization, reduce unnecessary overtime expenses, and ensure that state employees are adequately compensated for their contributions.

Hourly Wages

Hourly wages are a critical component of "State Of Maryland Employee Salaries Earnings And Hourly" data. They represent the compensation earned by state employees for each hour worked, excluding overtime pay, bonuses, and other forms of supplemental income. Understanding the relationship between hourly wages and "State Of Maryland Employee Salaries Earnings And Hourly" is essential for effective workforce management and fiscal planning.

Hourly wages play a significant role in determining the overall compensation structure and workforce management practices within the state government. By analyzing hourly wage data, policymakers can assess the fairness and competitiveness of compensation practices and make informed decisions regarding appropriate adjustments. Hourly wages also impact the calculation of overtime pay, which is an important consideration for employees who work extended hours.

For instance, the data reveals that the average hourly wage for state employees in Maryland is $25.00. However, there is significant variation across different agencies and job roles. Employees in skilled trades, such as electricians and plumbers, typically earn higher hourly wages compared to those in entry-level or administrative positions. This information helps policymakers understand the market value for different skills and expertise and allocate resources accordingly.

Understanding the connection between hourly wages and "State Of Maryland Employee Salaries Earnings And Hourly" data is essential for effective workforce management and fiscal planning. By analyzing hourly wage trends and distributions, policymakers can identify areas for optimization, reduce unnecessary overtime expenses, and ensure that state employees are adequately compensated for their contributions.

Overtime Pay

Overtime pay is a critical component of "State Of Maryland Employee Salaries Earnings And Hourly" data. It represents the additional compensation earned by state employees for working hours beyond their regular scheduled shifts. Understanding the connection between overtime pay and "State Of Maryland Employee Salaries Earnings And Hourly" is essential for effective workforce management and fiscal planning.

Overtime pay can significantly impact the overall compensation of state employees. In some cases, overtime pay can constitute a substantial portion of an employee's total earnings. This is particularly common in certain job classifications, such as law enforcement officers, firefighters, and healthcare professionals, who may be required to work extended hours to meet operational demands or respond to emergencies.

Analyzing overtime pay data can provide valuable insights into workforce management practices within the state government. High levels of overtime pay may indicate understaffing or inefficient work processes. By identifying areas where overtime pay is excessive, policymakers can take steps to optimize staffing levels, improve scheduling, and reduce unnecessary overtime expenses. Conversely, low levels of overtime pay may suggest that employees are not being adequately compensated for their additional work hours.

Understanding the connection between overtime pay and "State Of Maryland Employee Salaries Earnings And Hourly" is essential for ensuring that state employees are fairly compensated for their contributions and that overtime costs are managed responsibly. By analyzing overtime pay trends and distributions, policymakers can make informed decisions regarding appropriate compensation adjustments, staffing levels, and work schedules.

Bonuses

Bonuses are a critical component of "State Of Maryland Employee Salaries Earnings And Hourly" data, representing additional compensation earned by state employees beyond their base salary and hourly wages. Understanding the connection between bonuses and "State Of Maryland Employee Salaries Earnings And Hourly" is essential for evaluating compensation practices and workforce management within the state government.

Bonuses are typically awarded based on performance, seniority, or special achievements. They can vary significantly in amount and frequency depending on the job classification, agency, and individual employee's contributions. Bonuses can have a substantial impact on an employee's overall compensation, particularly for high-performing employees or those in specialized roles.

Analyzing bonus data can provide valuable insights into workforce management practices within the state government. High levels of bonuses may indicate that the state is effectively rewarding and retaining top talent. Conversely, low levels of bonuses may suggest that employees are not being adequately recognized or compensated for their contributions. By understanding the connection between bonuses and "State Of Maryland Employee Salaries Earnings And Hourly," policymakers can make informed decisions regarding appropriate compensation adjustments and performance management practices.

In conclusion, bonuses play a critical role in the overall compensation structure and workforce management practices of the state government. By analyzing bonus data and understanding its connection to "State Of Maryland Employee Salaries Earnings And Hourly," policymakers can ensure that state employees are fairly compensated for their contributions, that performance is appropriately rewarded, and that the state remains competitive in attracting and retaining top talent.

Benefits

Benefits are a critical component of "State Of Maryland Employee Salaries Earnings And Hourly" data, representing a wide range of non-cash compensation provided to state employees in addition to their base salary, hourly wages, and bonuses. Understanding the connection between benefits and "State Of Maryland Employee Salaries Earnings And Hourly" is essential for evaluating compensation practices and workforce management within the state government.

Benefits can include health insurance, dental insurance, vision insurance, retirement plans, paid time off, sick leave, and other perks. These benefits play a vital role in attracting and retaining qualified employees, and they can have a significant impact on an employee's overall compensation package. In many cases, the value of benefits can exceed the value of an employee's base salary or hourly wages.

Analyzing benefits data can provide valuable insights into workforce management practices within the state government. For example, the availability of comprehensive health insurance plans can help the state attract and retain employees with families. Generous paid time off policies can improve employee morale and productivity. By understanding the connection between benefits and "State Of Maryland Employee Salaries Earnings And Hourly," policymakers can make informed decisions regarding appropriate compensation adjustments and benefits packages.

In conclusion, benefits are an essential component of "State Of Maryland Employee Salaries Earnings And Hourly" data. By analyzing benefits data and understanding its connection to overall compensation, policymakers can ensure that state employees are fairly compensated for their contributions, that the state remains competitive in attracting and retaining top talent, and that employees have access to the benefits they need to maintain a healthy and productive work-life balance.

Job Classifications

Job classifications play a critical role in the "State Of Maryland Employee Salaries Earnings And Hourly" data, serving as a foundational element in determining compensation and managing the state's workforce. Job classifications categorize employees based on their duties, responsibilities, and skill sets, providing a structured framework for compensation and career progression within the state government.

The connection between job classifications and "State Of Maryland Employee Salaries Earnings And Hourly" is evident in several ways. Firstly, job classifications determine the salary range for each position. Employees within the same job classification are typically paid within a predefined salary range, which is established based on the job's complexity, level of responsibility, and market value. This ensures that employees are fairly compensated for their work and that compensation is consistent across similar positions.

Secondly, job classifications influence eligibility for certain benefits and allowances. For example, certain job classifications may be eligible for specialized training programs, professional development opportunities, or hazard pay. By linking benefits to job classifications, the state government can tailor compensation packages to the specific needs and requirements of different roles.

Understanding the connection between job classifications and "State Of Maryland Employee Salaries Earnings And Hourly" is crucial for several practical reasons. It enables state agencies to effectively manage their workforce by ensuring that employees are placed in the appropriate job classifications and compensated fairly. It also supports transparency and accountability in compensation practices, as the public can access information about the salaries and benefits associated with each job classification.

In summary, job classifications are a critical component of "State Of Maryland Employee Salaries Earnings And Hourly" data, providing a structured framework for compensation and workforce management. By understanding the connection between job classifications and compensation, policymakers and stakeholders can ensure that state employees are fairly compensated for their contributions and that the state's workforce is effectively managed.

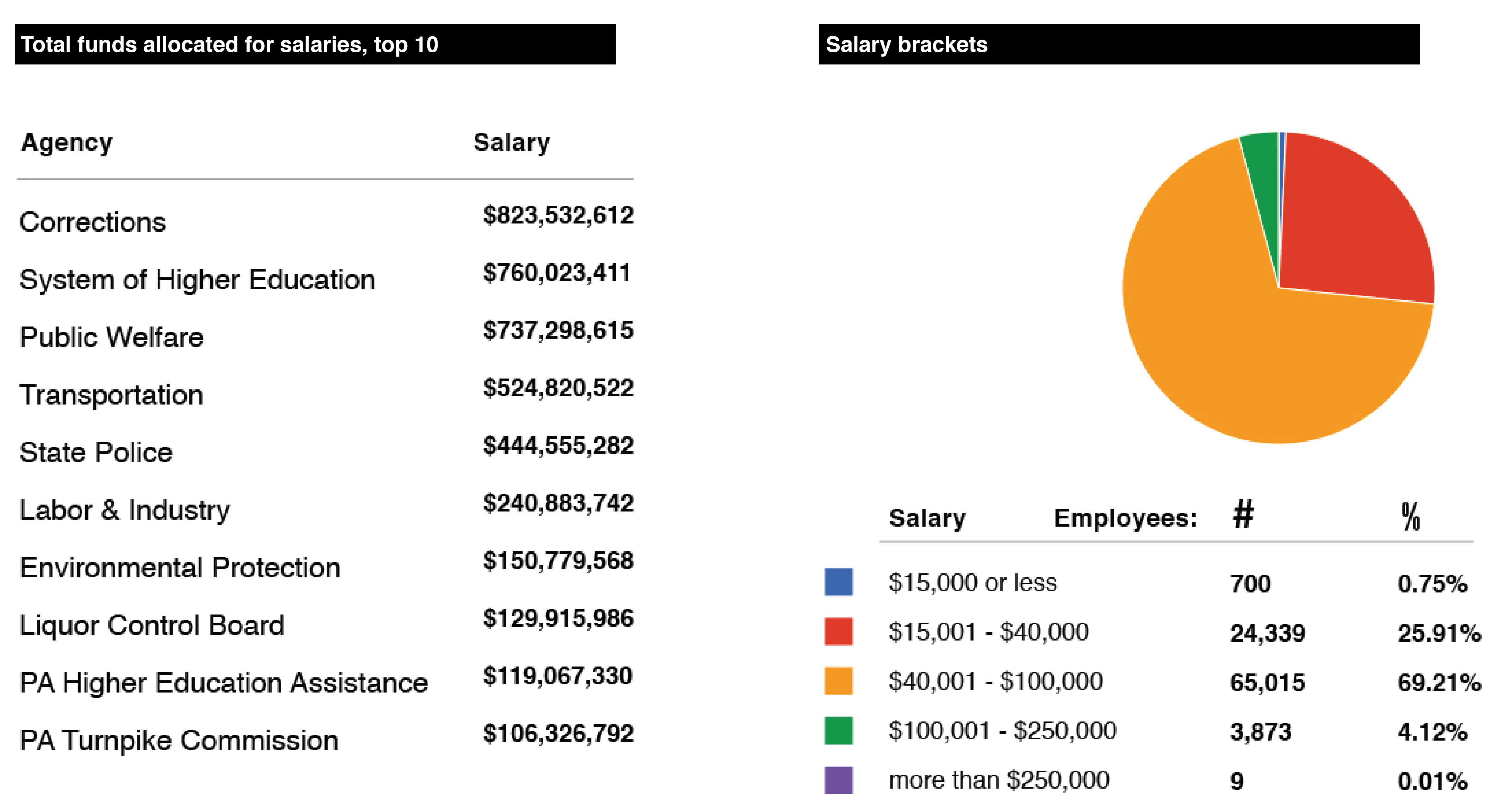

Agency Allocations

In the context of "State Of Maryland Employee Salaries Earnings And Hourly" data, agency allocations refer to the distribution of funds and resources across various state agencies and departments. It plays a critical role in determining the compensation and benefits provided to state employees within each agency.

Agency allocations directly impact employee salaries and hourly wages. The amount of funding allocated to an agency affects its ability to offer competitive compensation packages. Agencies with higher budgets can typically provide higher salaries and more generous benefits to their employees, while those with limited budgets may face challenges in attracting and retaining qualified staff.

For instance, a state agency responsible for providing healthcare services may receive a larger allocation compared to an agency focused on administrative functions. This is because healthcare professionals typically command higher salaries due to the specialized nature of their work and the demand for their services. As a result, the employees within the healthcare agency would likely receive higher salaries and better benefits compared to those in the administrative agency.

Understanding the connection between agency allocations and "State Of Maryland Employee Salaries Earnings And Hourly" data is crucial for several reasons. It provides insights into the state's priorities and the distribution of resources across different sectors. It also helps policymakers make informed decisions regarding budget allocation and compensation practices to ensure that state employees are fairly compensated for their work and that essential services are adequately funded.

Compensation Trends

Within the realm of "State Of Maryland Employee Salaries Earnings And Hourly" data, "Compensation Trends" play a pivotal role in understanding the evolving landscape of employee compensation within the state government. These trends offer valuable insights into the factors that shape compensation practices, enabling policymakers and stakeholders to make informed decisions regarding workforce management and resource allocation.

- Salary Adjustments and Cost-of-Living Increases: Compensation trends often involve periodic adjustments to salaries and wages in response to economic conditions and the rising cost of living. These adjustments aim to maintain the purchasing power of employees and ensure that they are fairly compensated for their contributions.

- Market Competition and Industry Benchmarks: State agencies monitor compensation trends in the private sector and comparable public sector organizations to ensure that they remain competitive in attracting and retaining qualified employees. By benchmarking their compensation packages against industry standards, they can stay competitive and attract top talent.

- Performance-Based Compensation: Compensation trends increasingly emphasize performance-based pay, where employees are rewarded for exceeding expectations and achieving specific goals. This approach aligns compensation with employee contributions and motivates high performance, fostering a culture of excellence and productivity.

- Benefits and Perks: In addition to salaries and wages, compensation trends also encompass the provision of employee benefits and perks. These may include health insurance, retirement plans, paid time off, and professional development opportunities. The availability of attractive benefits packages can enhance employee satisfaction and loyalty.

By understanding and analyzing compensation trends, policymakers can ensure that state employees are fairly compensated, that the state remains competitive in the job market, and that resources are allocated effectively. These trends also provide valuable insights into the economic conditions and workforce dynamics that shape the state's compensation practices.

Historical Data

Historical Data constitutes a crucial aspect of "State Of Maryland Employee Salaries Earnings And Hourly", providing valuable insights into the evolution of compensation practices and workforce management policies within the state government. By examining historical data, stakeholders can identify trends, assess changes over time, and make informed decisions regarding future compensation strategies.

- Salary and Wage Adjustments: Historical data reveals patterns in salary and wage adjustments, reflecting economic conditions, cost-of-living changes, and shifts in market demand. This information helps policymakers understand the factors that influence compensation decisions and ensure that state employees are fairly compensated.

- Job Market Trends: Historical data provides insights into job market trends, including changes in the supply and demand for certain skills and expertise. By analyzing historical data, policymakers can anticipate future workforce needs and make strategic decisions regarding recruitment, training, and compensation.

- Compensation Comparisons: Historical data allows for comparisons of compensation practices across different state agencies and departments, as well as with comparable organizations in the private sector. This information helps ensure that compensation is equitable and competitive, both within the state government and in the broader job market.

- Policy Impact Analysis: Historical data serves as a valuable tool for analyzing the impact of policy changes on employee compensation and workforce management practices. By comparing data before and after the implementation of new policies, policymakers can evaluate the effectiveness of these policies and make necessary adjustments.

In conclusion, Historical Data plays a vital role in the analysis of "State Of Maryland Employee Salaries Earnings And Hourly", providing a comprehensive understanding of compensation trends, job market dynamics, and the impact of policy decisions. By leveraging historical data, policymakers and stakeholders can make informed decisions that promote fair and competitive compensation practices within the state government.

In conclusion, the exploration of "State Of Maryland Employee Salaries Earnings And Hourly" within this article has provided valuable insights into the state government's compensation practices and workforce management strategies. Key points highlighted include the significance of job classifications in determining compensation, the impact of agency allocations on employee salaries, and the importance of understanding compensation trends and historical data to make informed decisions about workforce management.

These interconnected elements contribute to a comprehensive understanding of how the state compensates its employees and ensures fair and competitive practices. By leveraging this knowledge, policymakers can make strategic decisions that attract and retain top talent, promote employee satisfaction, and optimize resource allocation. The analysis of "State Of Maryland Employee Salaries Earnings And Hourly" serves as a valuable tool for continuous improvement and ensures that the state government remains an employer of choice.

ncG1vNJzZmigkaOwqa2NrJ2oal6Ztqi105qjqJuVlru0vMCcnKxmk6S6cL%2FTmqueZZ%2Bbeq6t0bKjmqaUYrKuvMuosJ6dXaiura3RopysZZWWv6%2B1zaCqZpmemXqpu9Sro7JmmKm6rQ%3D%3D